Nvidia (NVDA 1.46%) launched 30 years ago with a simple vision: Its founders wanted the gaming and multimedia markets to experience the power of 3D graphics. A few years later, the company revolutionized the computer industry by inventing the first graphics processing unit (GPU). Over the past few years, Nvidia's stock has skyrocketed in price and has left many investors wondering how they can get in on the action.

Nvidia has had a long history of innovation since developing the GPU. Today, the semiconductor company develops and manufactures processors that are vital for data centers, cloud-based platforms, gaming, automotive, and artificial intelligence (AI).

The company believes accelerated computing can help unlock the power of AI. Nvidia's GPUs power the AI software behind OpenAI's wildly popular ChatGPT program and other AI innovations.

Fellow tech behemoth Microsoft (MSFT 0.11%) is investing billions of dollars in OpenAI to help take the technology to the next level. Others in the tech sector have followed Microsoft's lead and are investing heavily in AI start-ups and related infrastructure.

Accelerated computing is also helping rev Nvidia's profit growth, boosting the company's stock price and making it a potentially excellent long-term investment. Here's a step-by-step guide on buying Nvidia shares and some factors to consider before investing in the technology stock.

What does it do?

What does Nvidia do?

While Nvidia stock has soared in popularity as a way to gain AI exposure, many investors aren't sure what the company does. Maybe they've heard of GPUs, maybe they've heard of data centers, or maybe they've heard of AI. However, the exact nature of Nvidia's business may remain shrouded in mystery.

The company organizes its business into two segments: compute & networking and graphics. The compute and networking segment accounts for the lion's share of Nvidia's business, 88 % of revenue and more than 97% of operating income for fiscal 2025.

The company's accelerated computing platforms, for example, help data centers manage the extraordinary computing demands of AI. According to the company, its data center solutions "can scale to tens of thousands of GPU-accelerated servers interconnected to function as a single giant computer."

Rounding out the company's business, the graphics segment comprises the GPUs provided for varying markets, including gaming, professional visualizations (workstations), and automotive. For fiscal 2026, these three markets represented 9%, 1.3%, and 1.2% of revenue, respectively.

While not as robust as the company's data center business, the gaming and automotive markets have represented some aspects of AI. Nvidia's GPUs, for example, are used in various types of autonomous vehicles.

Its platforms are indispensable for data centers attempting to manage the tremendous computing demands associated with large language models and other types of generative AI.

How to invest

How to buy Nvidia stock

You can buy shares of Nvidia in any brokerage account. If you still need to open one, these are some of the best-rated brokers and trading platforms.

- Open your brokerage account: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Should I invest?

Should I invest in Nvidia?

Here are some reasons you might consider investing in Nvidia stock:

- You want to invest in a company capitalizing on the long-term demand growth for computing power.

- You want to invest in a profitable and financially strong company.

- You use Nvidia's technology in gaming or computing applications.

- You like the company's investments in providing solutions for exciting growth sectors, like AI and autonomous vehicles.

- You believe Nvidia stock can outperform the S&P 500 over the long term.

- You think the company's accelerated computing strategy will drive profit growth in the coming years.

- You believe Nvidia can continue to be an innovator.

- You don't rely on dividend income and are content with the company's small payment.

- You understand Nvidia's stock could be volatile and might lose value.

- You want to invest in a founder-led company and believe that co-founder and CEO Jensen Huang can continue growing shareholder value.

Shareholder Value

Conversely, here are some reasons you might decide Nvidia isn't the right stock for you:

- You're worried about a potential slowdown in tech-related spending and its potential effect on Nvidia's data center products.

- You don't understand what the company does or how it makes money.

- You're concerned about AI and unsure if it will live up to the hype.

- You're looking for investments with lower volatility than Nvidia stock.

- You're seeking more dividend income than Nvidia currently provides.

- You're concerned about Nvidia's high valuation following its AI-driven rally.

- You're concerned about problems in the global supply chain and Nvidia's ability to get its chips around the world.

Profitability

Is Nvidia profitable?

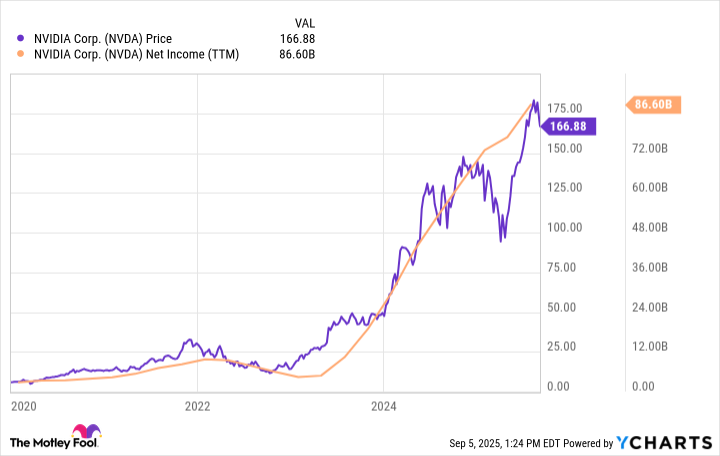

Profit growth helps drive stock price appreciation over the longer term, making it an ideal area for beginning investors to focus on before buying shares of any company. Nvidia is spectacularly profitable.

The company generated more than $40 billion in revenue in its 2026 fiscal second quarter, up 56% year over year and 6% from the previous quarter. Their data center revenue is driving consistent results.

Nvidia produced almost $26 billion of net income in the quarter. That was up 52% year over year. The company's robust profit growth has been a major catalyst for its soaring stock price:

Nvidia also generates lots of cash. In its 2026 fiscal second quarter, the company produced $14.5 billion in cash from operations and $13.5 billion in free cash flow.

The cash flow gave it the funds to invest in continued innovation while returning money to shareholders through dividends and share repurchases. Even with the hefty cash returns, it ended the period with a cash-rich balance sheet.

Dividends

Does Nvidia pay a dividend?

Nvidia initiated a dividend in 2012 and steadily increased its payout for the first several years after declaring its initial dividend. While the company had stopped raising its payout in more recent years, that came to an abrupt end in 2024 when it declared a monster 150% raise.

However, the company still offered a very low dividend yield in 2025 (0.024% compared to less than 1.5% for the S&P 500). Although Nvidia doesn't pay a big dividend, it returns significant cash to investors through share repurchases.

ETF options

ETFs with exposure to Nvidia

Instead of actively buying shares of Nvidia directly, you can passively invest in the technology company through a fund holding its shares. Nvidia is one of the world's largest companies by market capitalization and is a widely held stock.

Nvidia is in several stock market indexes, including the S&P 500 and Nasdaq Composite index. As a result, index funds and exchange-traded funds (ETFs) that benchmark their returns against those indexes hold Nvidia stock. According to ETF.com, 681 U.S. ETFs held 3.5 billion shares of Nvidia as of 2025. The ETFs with the most shares were:

| Exchange-Traded Fund | Nvidia Shares Held | Fund Weighting | Position Ranking in Fund |

|---|---|---|---|

| Vanguard S&P 500 ETF (NYSEMKT:VOO) | 603.68 million | 8% | First-largest |

| iShares Core S&P 500 (NYSEMKT:IVV) | 294.15 million | 7.6% | First-largest |

| SPDR S&P 500 ETF Trust (NYSEMKT:SPY) | 292.86 million | 7.6% | First-largest |

Given its large market cap, Nvidia is among the top five holdings of the five largest ETFs by assets under management (AUM). The Vanguard S&P 500 ETF (VOO 0.25%) owns the most shares and has a meaningful portfolio weighting among the biggest ETFs. That makes it a solid option for investors seeking exposure to Nvidia.

Stock splits

Will Nvidia stock split?

Nvidia completed a 10-for-1 stock split in June 2024, one of several it has completed throughout its history:

| Split Date | Stock Split |

|---|---|

| June 2024 | 10:1 |

| July 2021 | 4:1 |

| September 2007 | 3:2 |

| April 2006 | 2:1 |

| September 2001 | 2:1 |

| June 2000 | 2:1 |

Nvidia's June 2024 stock split brought its share price from a pre-split level of more than $1,200 to around $120 a share (and it was around $125 a share in early October). That's a much more accessible level for investors. However, if the share price continues to rise, Nvidia might join the list of companies with an upcoming stock split once again.

Related investing topics

The bottom line on investing in Nvidia stock

Nvidia's continued innovation has helped drive the company's profit and stock price higher over the years. The company's investments in accelerated computing positioned it to capitalize on the enormous potential of AI, igniting its earnings and stock price. Nvidia believes it's still in the early innings of the AI boom, which could make it a great long-term investment.

FAQ

How to invest in Nvidia stock: FAQ

Can I invest in Nvidia stock?

Nvidia is a publicly traded company. Anyone with a brokerage account can invest in its stock.

Where can I invest in Nvidia?

You can invest in Nvidia through a brokerage account. It's easy to buy shares of Nvidia. Open and fund a brokerage account, fill out the order page, and submit the trade.

Is Nvidia a good investment?

Nvidia has been an outstanding investment over the years. As of 2025, Nvidia had delivered a more than 72% average annual return to its investors over the last 10 years. That significantly outperformed the S&P 500 (11.3% average annual return).

While past outperformance is no guarantee of future success, Nvidia is in an excellent position to continue producing outsize returns. It's a leader in making semiconductors for AI, which has become a major growth driver for the company.

Will Nvidia stock split?

Nvidia has completed seven stock splits in its history, with the last one (10-for-1) completed in 2024, when shares were about $1,200. Given the size and recency of its latest split, Nvidia likely won't complete another one any time soon.

What will Nvidia be worth in five years?

There are various opinions regarding what Nvidia will be worth in five years. In late 2025, the company had an astounding $4.05 trillion market cap. One analyst who follows the company believes it could be worth $10 trillion by 2030 or sooner.

However, others are less optimistic. Another analyst pointed out that the company needed to grow its earnings at a 70% annual rate over the next five years, more than double the rate the analyst community expected, to justify its market value in late 2025.

If the company can continue growing at a blistering pace, its value could double or triple over the next five years. However, if its growth slows, its stock could come back down to earth.

What is the stock price prediction for Nvidia in 2025?

The consensus 12-month price target among Wall Street analysts who follow the company is $181.27 per share. Analysts have a wide range of predictions, with the lowest target at around $100 a share and the highest at $250.